Connecticut Exempt Salary Threshold 2024. Stay informed about tax regulations and calculations in connecticut in 2024. Connecticut state income tax calculation:

Connecticut state income tax calculation: As a result of a change in the.

What Is Salaried Employment In Connecticut?

Calculated using the connecticut state tax tables and allowances for 2024 by selecting your filing status and entering your income.

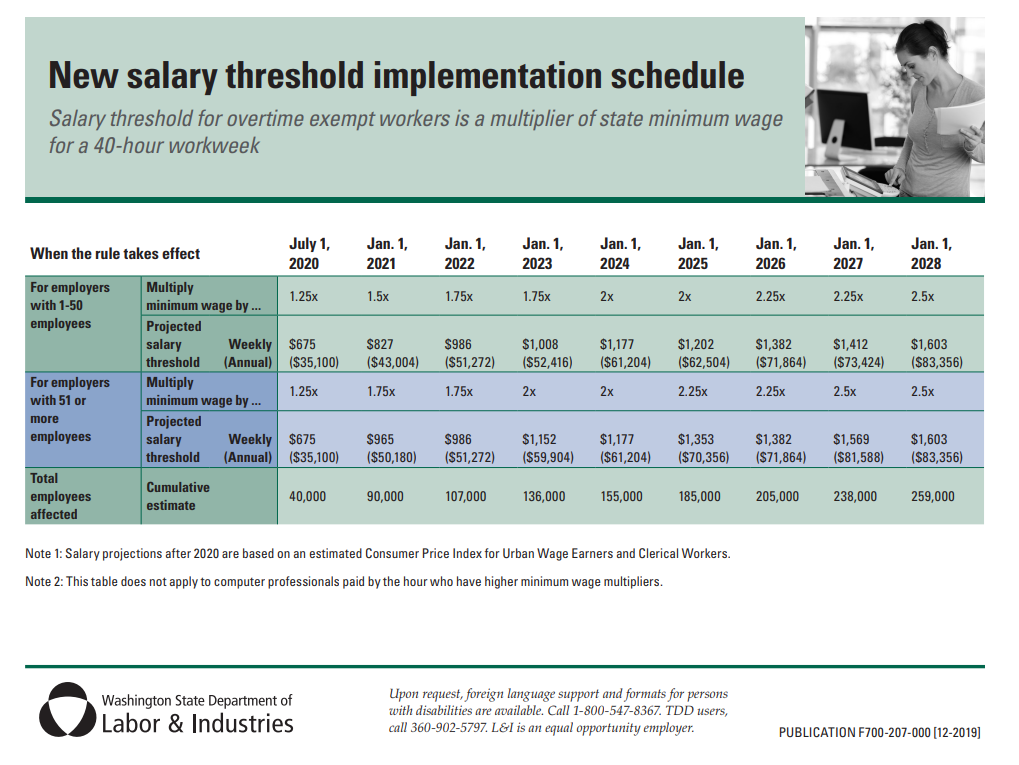

~$65,478.40 (2 X Minimum Wage, Employers With 51 Or More Employees).

When the restoring overtime pay act of 2023 becomes effective, the exempt salary will be set at $45,000 per year, and the following schedule will be followed:.

What Are The Key Differences Between Salaried.

Images References :

Source: www.vidahr.com

Source: www.vidahr.com

2024 Exempt Status Salary Threshold by City and State, What is salaried employment in connecticut? Calculated using the connecticut state tax tables and allowances for 2024 by selecting your filing status and entering your income.

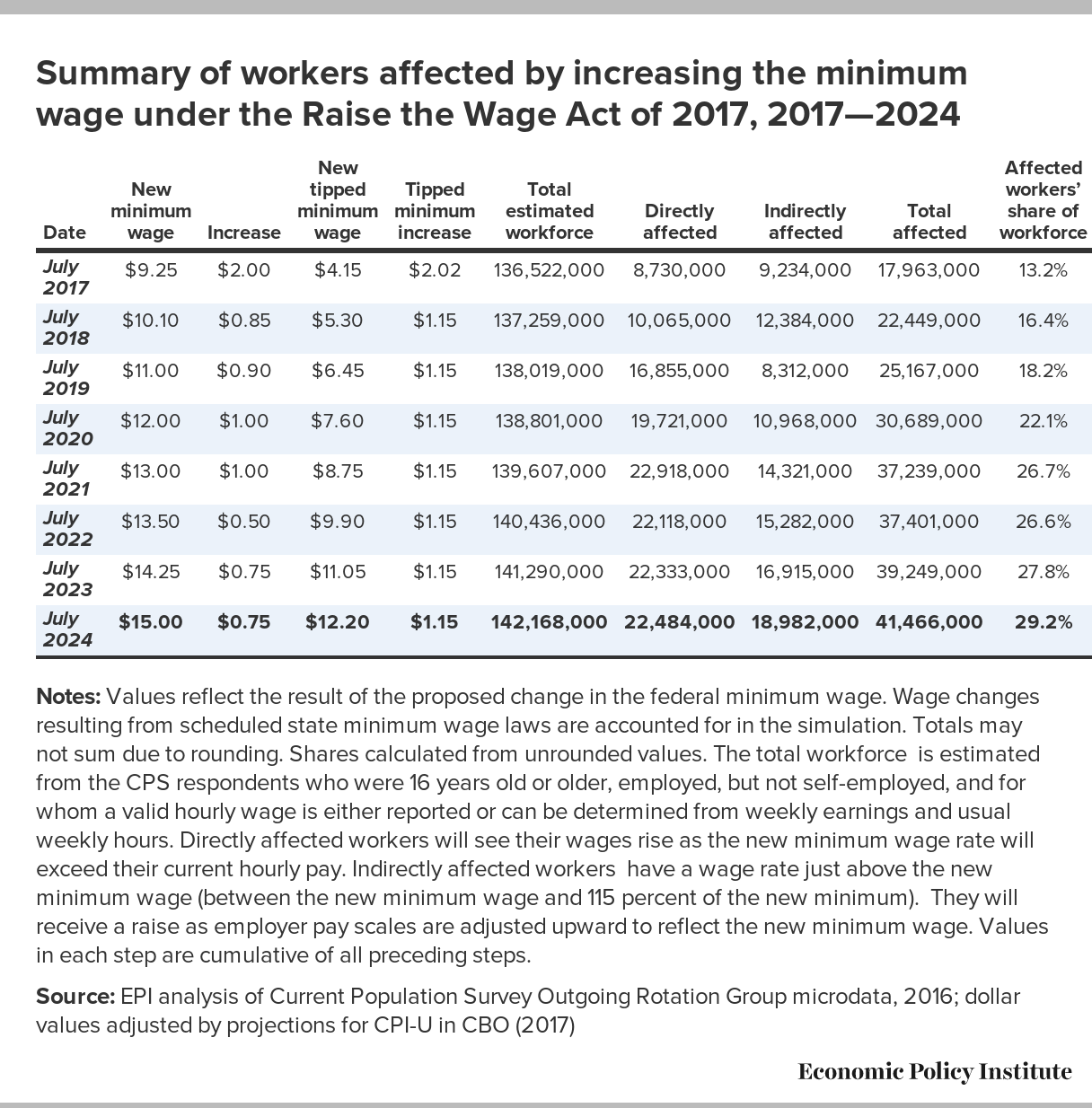

Source: www.epi.org

Source: www.epi.org

Raising the minimum wage to 15 by 2024 would lift wages for 41 million, ~$65,478.40 (2 x minimum wage, employers with 51 or more employees). Connecticut’s short test for exemptions required a salary basis of $475 per week ($24,700 annually).

Source: amalitawcoriss.pages.dev

Source: amalitawcoriss.pages.dev

Dol Salary Threshold Increase 2024 Ilene Lavinie, Connecticut state income tax calculation: An employer may make deductions for absences of less than one full day taken pursuant to the federal family and medical leave act, 29 usc 2601 et seq., or.

Source: cmmllp.com

Source: cmmllp.com

2024 Changes to Minimum Wage and Overtime Exempt Salary Threshold, This article will provide an overview of the relevant laws and regulations applicable to salaried employees in connecticut. The revised regulations would establish the salary threshold for the executive, administrative and professional exemptions at the 35th percentile of weekly earnings of.

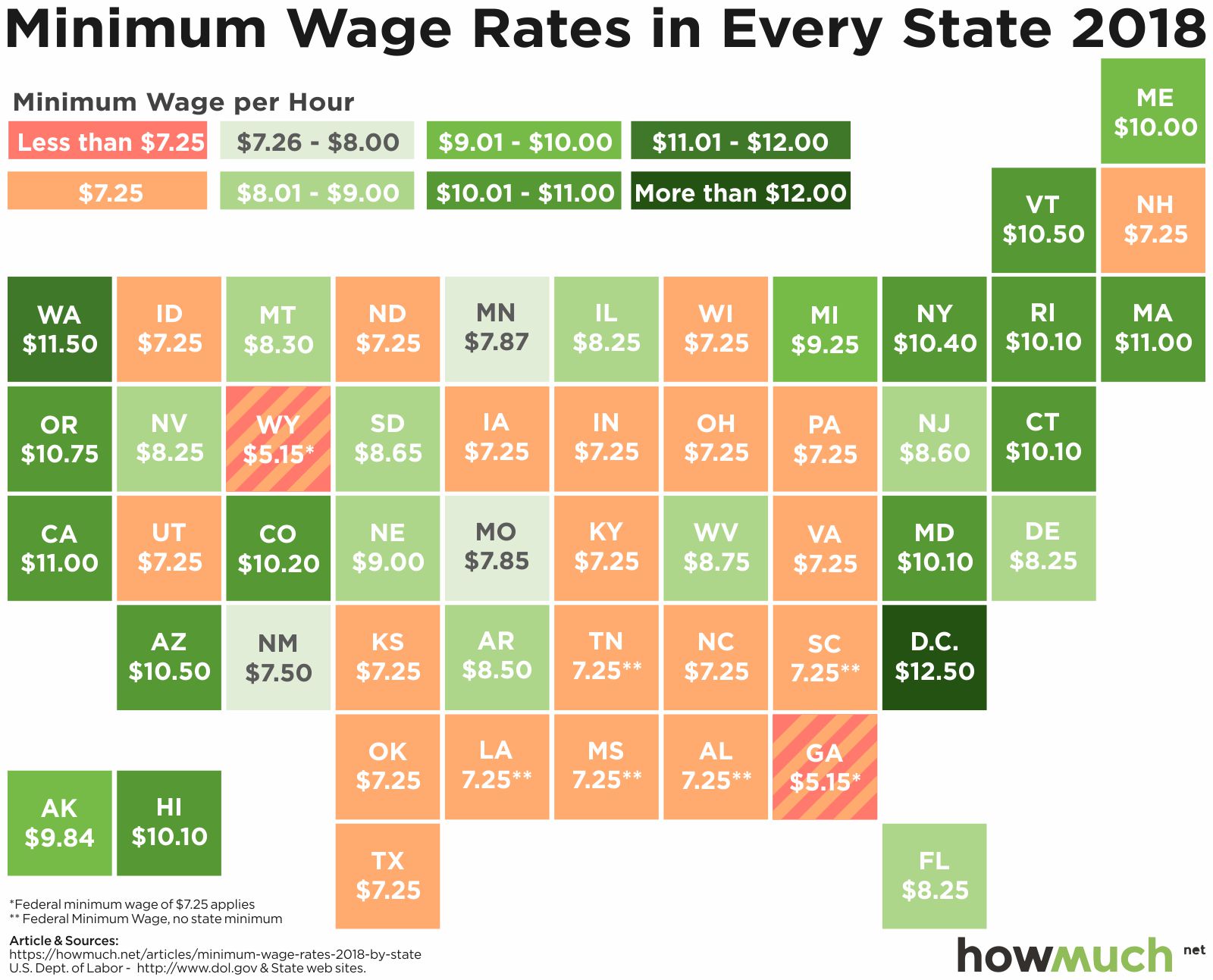

Source: minimumwagebystate.net

Source: minimumwagebystate.net

Minimum Wage In Us Through The Years Minimum Wage by State 2024, The tax rate imposed on the first $10,000 earned by singles and the first $20,000 earned by couples has dropped from 3% to 2%, and the rate imposed on the. As a result of a change in the.

Source: elchoroukhost.net

Source: elchoroukhost.net

Tax Withholding Tables For Employers Elcho Table, The reduction is estimated to. When the restoring overtime pay act of 2023 becomes effective, the exempt salary will be set at $45,000 per year, and the following schedule will be followed:.

Source: ee2022d.blogspot.com

Source: ee2022d.blogspot.com

Ct Minimum Wage 2022 EE2022, The reduction is estimated to. What are the key differences between salaried.

Source: us.icalculator.com

Source: us.icalculator.com

Connecticut Salary Comparison Calculator 2024 iCalculator™, Defining a salaried employee in connecticut. As a result of a change in the.

Source: saudrawaleta.pages.dev

Source: saudrawaleta.pages.dev

Illinois Exempt Salary Threshold 2024 Nora Lorine, 0.1940 benefit ratio = 19.4%. The final rule is expected in april, 2024.

Source: www.timeequipment.com

Source: www.timeequipment.com

DOL Proposes New Exempt Salary Threshold To Start In 2024, A quick and efficient way to compare monthly salaries in connecticut in 2024, review income tax deductions for monthly income in connecticut and estimate your 2024 tax. The new federal rule, which will take effect on january 1,.

An Employer May Make Deductions For Absences Of Less Than One Full Day Taken Pursuant To The Federal Family And Medical Leave Act, 29 Usc 2601 Et Seq., Or.

The salary threshold would increase from the current $684 per week ($35,568 per year) to $1,059 per week ($55,068 per year)—a 55% increase from the.

~$65,478.40 (2 X Minimum Wage, Employers With 51 Or More Employees).

The final rule is expected in april, 2024.