Solo 401k Contribution Limits 2024 Calculator Opm. Solo 401 (k) contribution calculator. Limitations of solo 401(k) contribution calculation accuracy.

Employees can contribute up to $23,000 to their 401 (k) plan for 2024 vs. Is my solo 401(k) plan subject to the corporate transparency act (cta)?

For 2024, The Contribution Limit Increases Again To $23,000.

The maximum percentage contribution to a 401 (k) is 100% of your compensation.

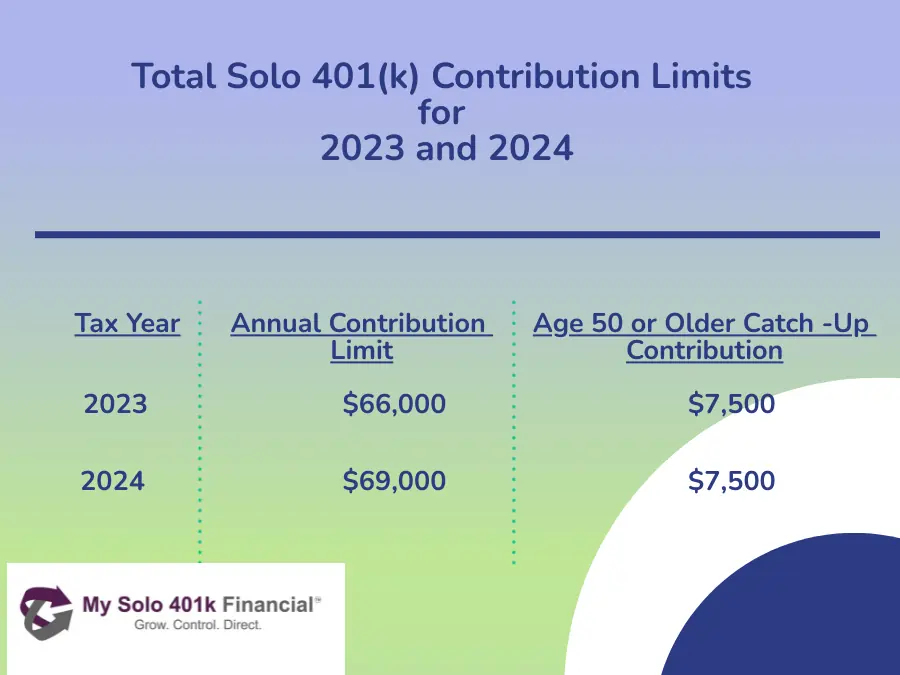

This Is Up From $66,000 And $73,500 In 2023.

You may be able to contribute up to $69,000 in 2024.

Free 401K Calculator To Plan And Estimate A 401K Balance And Payout Amount In Retirement Or Help With Early Withdrawals Or Maximizing Employer Match.

Images References :

Source: cigica.com

Source: cigica.com

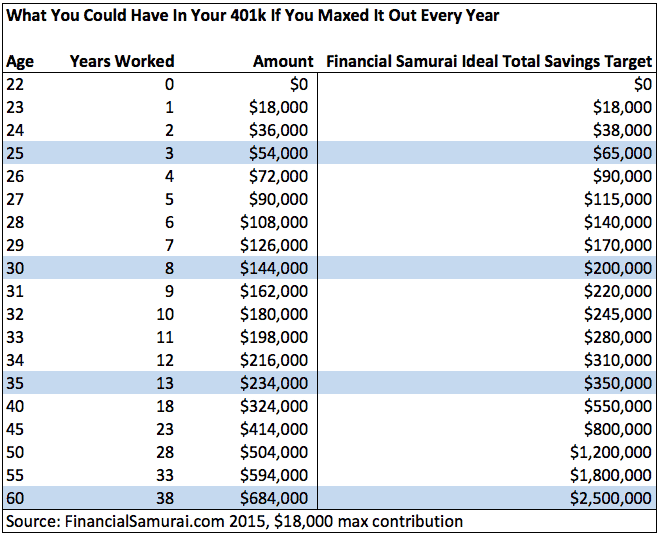

What’s the Maximum 401k Contribution Limit in 2022? (2023), The combined result is a retirement savings plan you can’t afford to. In 2024, you can make a total contribution to a solo 401k is $23,000, or $30,500 if you’re 50 or older.

Source: meldfinancial.com

Source: meldfinancial.com

401(k) Contribution Limits in 2023 Meld Financial, Calculate your maximum employee contribution: This calculator will calculate the maximum contribution that an individual is able to make to a solo 401 (k).

Source: www.abovethecanopy.us

Source: www.abovethecanopy.us

Here's How to Calculate Solo 401(k) Contribution Limits, For 2024, the contribution limit increases again to $23,000. The irs allows a maximum contribution per taxpayer of $66,000 for 2023 and $69,000 for 2024 to a company 401k plan.

Source: millennialmoneyman.com

Source: millennialmoneyman.com

Solo 401k Contribution Limits for 2022 and 2024, If you are 50 or older, you can contribute an extra $7,500 bringing your total contribution limit per plan to. Find out how much you can contribute to your solo 401k with our free contribution calculator.

Source: www.youtube.com

Source: www.youtube.com

2024 Solo 401(k) Maximum Contribution Limits YouTube, You may be able to contribute up to $69,000 in 2024. Participants age 50 or older may add an additional.

Source: lanettewsofia.pages.dev

Source: lanettewsofia.pages.dev

Annual 401k Contribution 2024 gnni harmony, Save on taxes and build for a bigger retirment! The irs allows a maximum contribution per taxpayer of $66,000 for 2023 and $69,000 for 2024 to a company 401k plan.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

The Maximum 401(k) Contribution Limit For 2021, Employees can contribute up to $23,000 to their 401 (k) plan for 2024 vs. Calculate your maximum employee contribution:

Source: zaharawleese.pages.dev

Source: zaharawleese.pages.dev

Max 401k Contribution 2024 Calculator Reggi Charisse, What are the new solo 401k contribution limits for 2024? 2024 401 (k) contribution limits.

Source: www.sensefinancial.com

Source: www.sensefinancial.com

Infographics IRS Announces Revised Contribution Limits for 401(k), This is up from $66,000 and $73,500 in 2023. The ira catch‑up contribution limit for individuals aged 50 and older remains at.

Source: www.mysolo401k.net

Source: www.mysolo401k.net

TotalSolo401kContributionLimitsfor2023and2024 My Solo 401k, The total combined 401 (k) contributions limit of both you and your employer is $69,000. You can make solo 401 (k) contributions as both the employer and employee.

Free 401K Calculator To Plan And Estimate A 401K Balance And Payout Amount In Retirement Or Help With Early Withdrawals Or Maximizing Employer Match.

The combined result is a retirement savings plan you can’t afford to.

Your Maximum Solo 401K Contribution Is $69,000 Per Participant Per Year.

This calculator will calculate the maximum contribution that an individual is able to make to a solo 401 (k).